An example of critical illness insurance

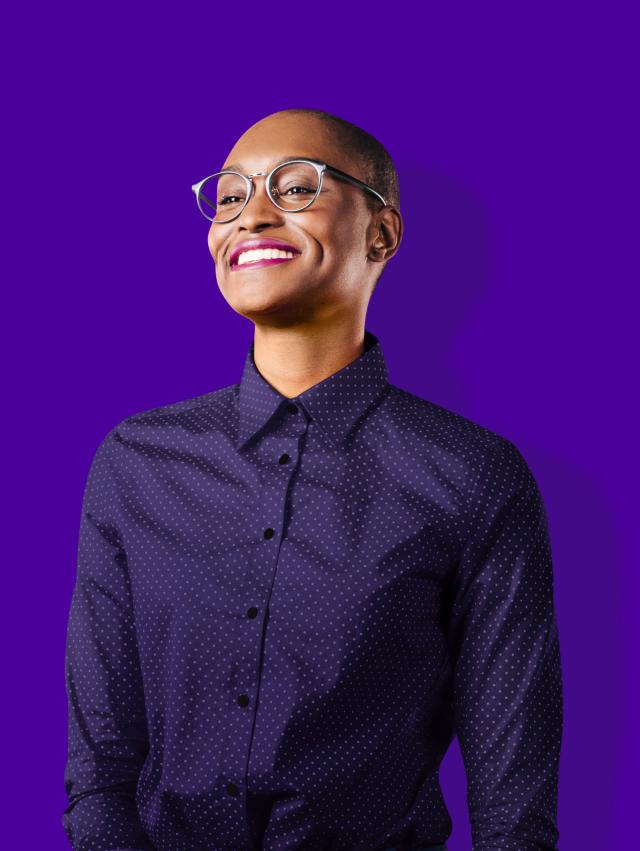

Simon, restaurant owner

This self-employed worker2 from Quebec City in his forties does not have group insurance and wants to be able to hire an employee to avoid closing his business in the event of a critical illness.