RRSP

Registered retirement savings plan: Save more, pay less income tax

Bonus! We increase return rates on deposits over $10,000.1

Return

Up to 4.60%

Risk

Low

Or give us a call at

1 866 612-3473

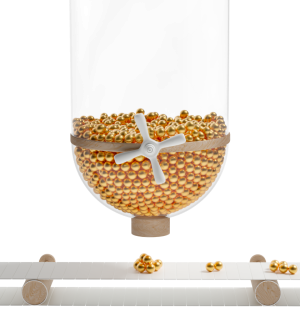

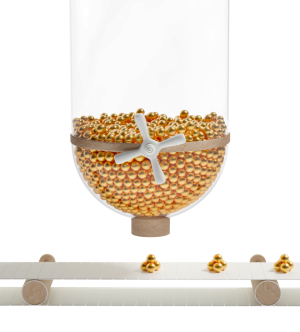

How does a Guaranteed Interest Account (GIA) work? Simply put, it's like lending your money to an institution for a term that you determine when you initially sign a contract.

At maturity, you get back all the money you “loaned”, plus predetermined and guaranteed interest. This play-it-safe option rules out the unexpected.

The more you invest, the better the rate of return.

Bonus! We increase return rates on deposits over $10,000.1

Like a loan, your investment has a term that you choose with your advisor when signing a contract.

The longer the term, the more attractive the return rate.

These funds are then invested until the end of the contract, unless you choose a redeemable GIA. Just make sure you don’t have any plans for this money until then!

You have 2 options with a traditional GIA:

Beneva only works with portfolio managers who are signatories to the UN Principles for Responsible Investment.

We take great care in proposing diversified investments adapted to your profile.

As a member company of Assuris, your investments are covered up to $100,000 or 90% of the accumulated value, whichever is greater.3

When you invest with an insurer, you can designate a beneficiary to receive the balance of your account in the event of death.

Registered retirement savings plan: Save more, pay less income tax

Registered retirement income fund: Turn your RRSP savings into income

Life income fund: Withdraw from your LIRA or pension at retirement

Locked-in retirement account: Manage your pension your way

Individual pension plan: for business owners who want to plan the next chapter with confidence

If you’ve maxed out your RRSP and TFSA contributions and still want to invest, you can go with the non-registered option. No tax perks, but no restrictions either!