RRSP

Registered retirement savings plan: Save more, pay less income tax

Pro tip for investors:

It's a little-known fact that investing with an insurer brings something extra to the table.

Beneva only works with portfolio managers who are signatories to the UN Principles for Responsible Investment.

Sums invested in savings and retirement plans are protected by Assuris. See the leaflet for full details.

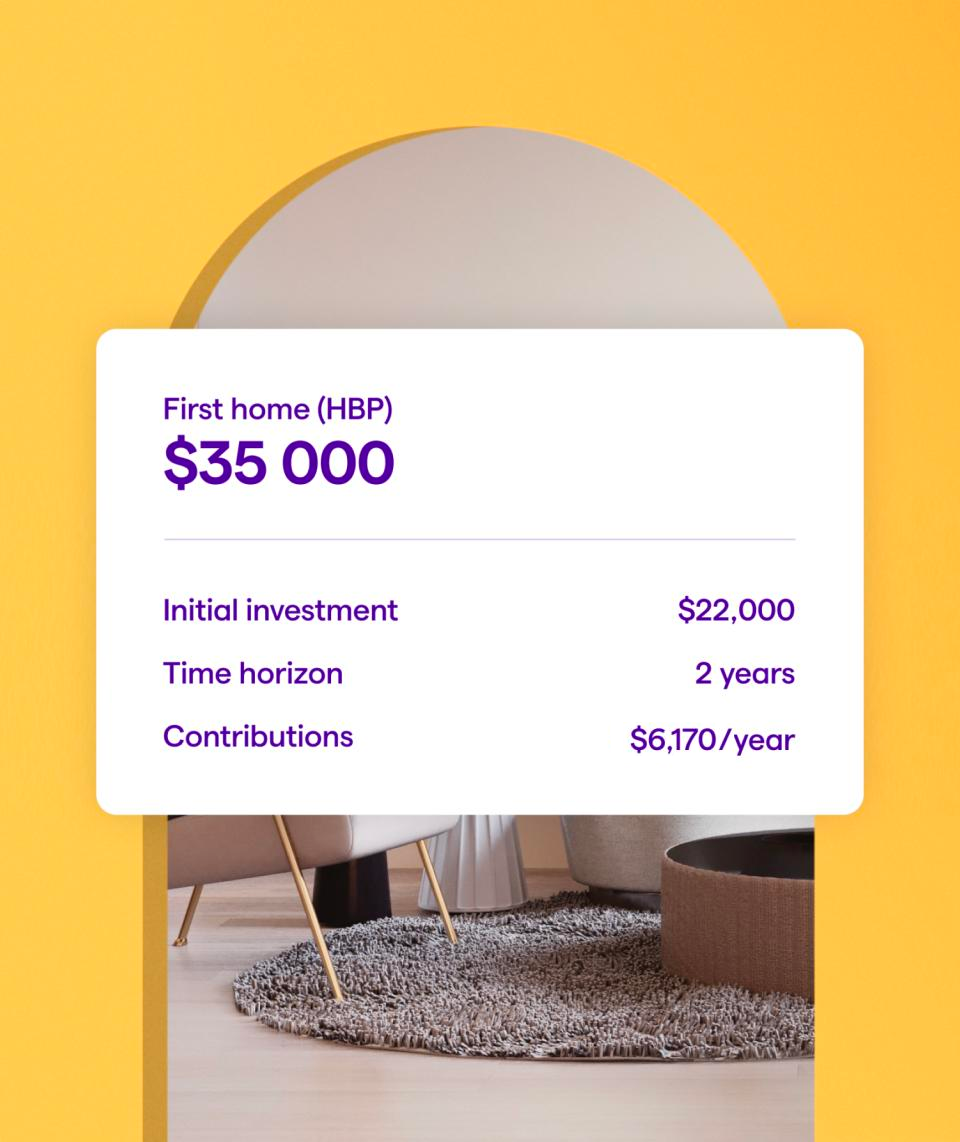

Together, we map out your investment plan to reach your goals, whether it’s retirement, the trip of a lifetime… or both! We’ll look at:

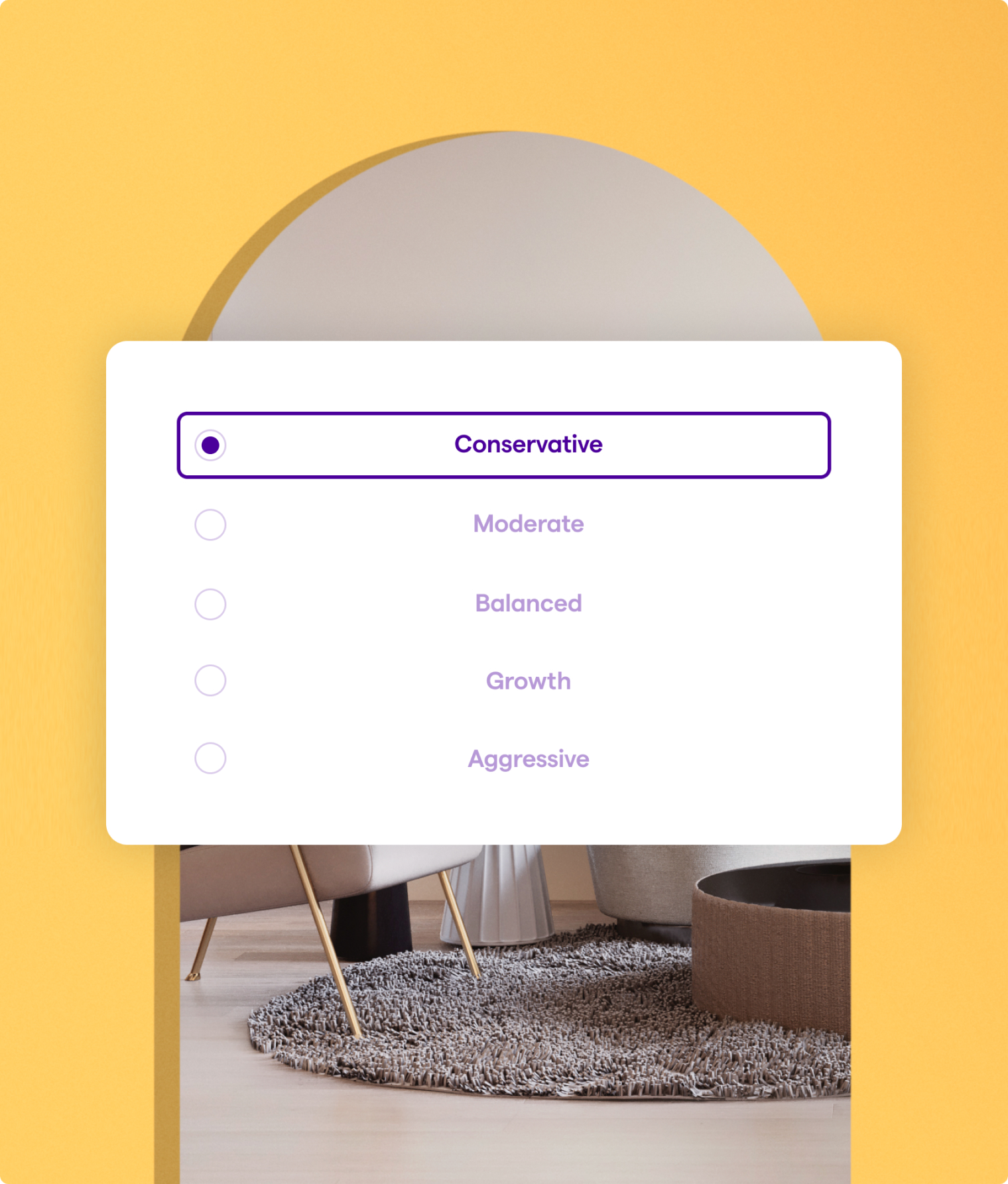

Now it’s time to choose your plan and investment products. This is the part where we develop a strategy aligned with your goals and really put your money to work.

We’ll determine, among other things, your:

Stick to your contribution plan, let us know when adjustments are needed… and let your investments do the rest.

Cash in when you've reached your goal. Your advisor will walk you through this step and help you steer clear of tax penalties whenever possible!

That’s the great thing about a financial advisor—you get expert help planning your life goals, big and small.1 You’ve worked hard for your money, let it return the favour.

The scenario shown here is for demonstration purposes only and should not be relied upon as financial or other advice.2

Take control of your financial future. Sign up for one of our financial security webinars and get clear, useful and practical information to use in your current situation.

Looking to reduce your debt, save better and build a solid financial plan? Register for this webinar to get practical advice today. We can work together to make your financial goals a success.

Dreaming of a stress-free retirement but not sure where to start? This webinar is right up your alley! Find out everything from budget management to maximizing your savings through RRSPs or TFSAs, along with the ins and outs of government pension plans.